|

|||

|

|||

|

If the governorís recently-unveiled budget proposal is passed as is, it could eliminate 105,000 jobs in New York State, eviscerate the stateís most successful job-creation program, and severely impact small retailers.

The governorís proposed cuts to health care and education would not only limit health care services and lower academic standards, but could increase unemployment. The governorís $2 billion cut to Medicaid and health care services could eliminate 48,000 jobs, and cuts to elementary and secondary schools, as well as colleges and universities, could cost New York 57,000 jobs.

There is no doubt that we have tough decisions to make this year. But taking jobs away from working families is the wrong decision.

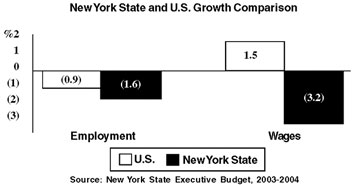

During the years of the Pataki administration between 1995 and 2001, the nationís employment grew by 15.6 percent, while New York State employment grew by only 9.4 percent. If New York State employment had grown at the same rate as the nation over that period, 476,700 additional jobs would have been created. Now the governor has put forward a proposed state budget that will put New York even further behind the rest of the country in job growth.

The governor proposes eliminating over $3.5 million in funding to local Empire Zone administrators, and originally proposed forcing local governments to pay half the cost of the program. His proposals call into question his commitment to the enormously successful program, and could threaten its long-term viability. This Assembly-initiated program is designed to cut costs for businesses in economically struggling areas of the state and help companies create more jobs. Undermining the program is not only a bad decision ó itís a slap in the face to every community in our state working to improve its struggling economy.

The governorís rhetoric does not match reality. To make matters worse for local economies, the governor wants to eliminate the sales tax exemption on clothing articles under $110, which would amount to over $13 billion in exempt retail purchases being subjected to state and local sales taxes. This job-killing tax hike would force consumers out of state to purchase clothing and could run many small retailers out of business.

And by slashing school aid $1.4 billion, increasing class sizes, and shutting down pre-K programs, the governorís proposal not only jeopardizes our childrenís education, his cuts could also cause schools to lay off teachers, while forcing double digit tax hikes on property taxpayers.

The Assembly is committed to making the right choices for all New Yorkers and will fight for a budget that isnít balanced on the backs of working families.